Business banking is a crucial element of our lives, and with the trend of digitization, many people depend on on-line consumer banking. But it’s not always possible to get away from the requirement for exploring the lender and getting together with the lender teller. With a huge selection of buyers seeing the bank every single day, a lender teller’s function will become vital in cashier’s tray delivering trouble-cost-free service. In this particular website, we’ll go over how the teller windowpane was a icon of consumer banking performance.

The teller home window, often known as the bank cage or cashier’s workplace, is the place where buyers make transactions with banking institution staff. Bank consumers line up on the teller windowpane, depositing their inspections or withdrawing their cash. This system of operation has been doing place considering that the beginning of banking. Digital banking makes wonderful strides over the past several years, although the teller home window is always important for catering to customers’ demands who cannot handle their dealings digitally.

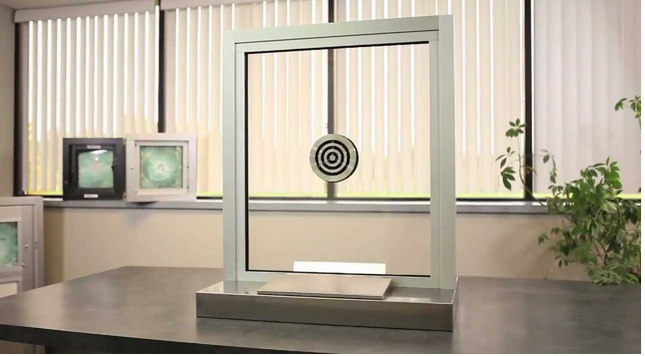

In the early days, each and every financial institution might have a teller stall having a higher counter-top and night clubs, with all the teller confined inside. It absolutely was made to guard the teller from people that intended to hurt them or take funds. Later, the cage was replaced with a minimal kitchen counter, as well as the teller’s office chair was installed behind it. This layout permitted for higher connection and proposal with buyers, permitting the teller to totally recognize their needs.

Today, the present day teller window was designed to increase productivity and boost the customer experience. Buyers can communicate with their teller via movie conferencing using the Interactive Teller Equipment (ITM). Banks can also be making use of Automated Teller Equipment (ATMs), in which buyers is capable of doing a variety of business banking functions, including withdrawals, deposits, and account questions.

The teller window’s style includes engineering changes, which includes distance sensors and camcorders, offering true-time information to enhance its performance. These range devices recognize when consumers method and inform the teller of the presence, which speeds up the transaction approach. The camcorders encourage the teller to ensure the customer’s identity before handling their dealings.

In a nutshell:

In In a nutshell, the teller windows has come a long way from its early days. It is now a necessary element of providing effective company to financial institution clients. Using the improvements in technological innovation and style, financial institutions are using the teller windows to boost their assistance expertise and meet the needs of customers’ demands in the best possible way. When digital banking has launched several positive aspects, the importance of human being interaction with a financial institution teller should not be neglected. The teller windowpane has become a symbol of productivity, believe in and it has made business banking a whole lot simpler.